Pay Off Debt

Step 3 - Plan your finances

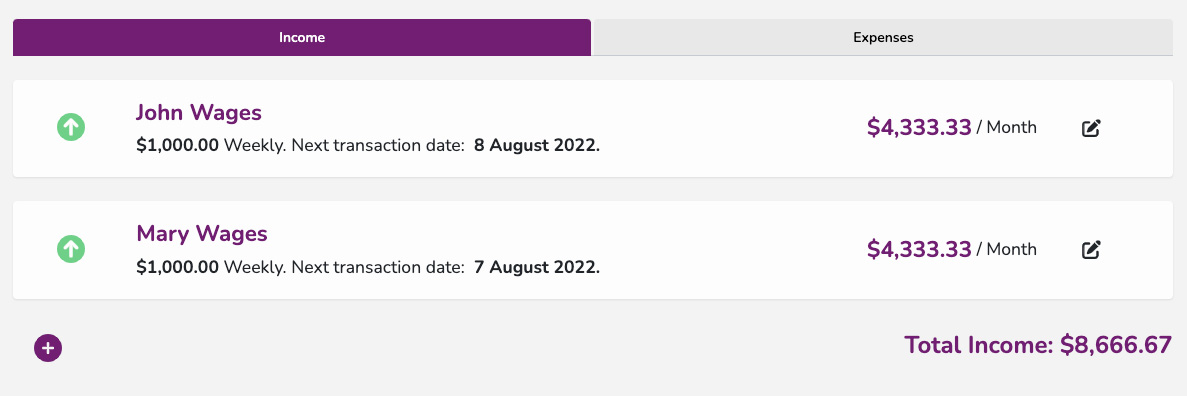

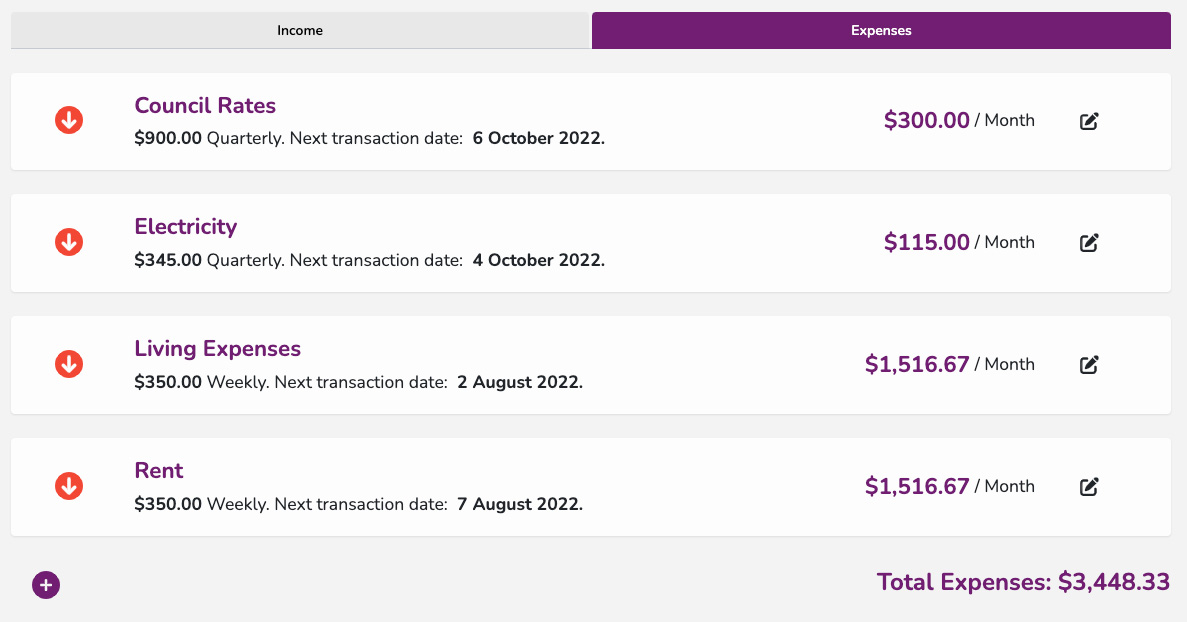

Now that you have your basic accounts in place, you need to plan your regular income and expenses. In order to do this, go to the MoolaPlannr page where you can enter your income and expenses. Don't enter loan expenses here as these will be handled separately.

Income

First, work out how much money you will receive in wages, government assistance, rental income etc, as a monthly amount for each. If the amount isn't a regular amount (ie you work casually rather than fulltime), use your average monthly income over the previous 6 months. This is a fairly reliable indicator of what you can expect in the future.

Enter these after-tax amounts into the "Income" section of your MoolaPlannr.

Expenses

Examine your bank statements to determine what expenses can be considered recurring and roughly the same amount for a given period (weekly, fortnightly, monthly, quarterly, yearly). Don't include loan repayments as we handle these separately. Expenses such as:

- Living Expenses (this amount gets regularly transferred to your living expenses account - see below)

- Rent

- Electricity Bills

- School Fees

- Vehicle Registration

- Insurance (car, house)

Living Expenses

This is an amount that you (and your partner) discuss to determine how much will be regularly transferred to your living expenses account. If you're not sure how much this is, start with a low amount that you think may be sufficient and see how it goes. If you find you're always running out of money, increase it. Likewise if you find you have money left over you can decrease it. Try to keep an agreed minimum amount in your living expenses account in case you should need additional money for a given week, but often it's best to allow the account to run out of money so that you're aware that you've spent too much for a given week.

As you enter your income and expenses, notice how the remainder is being updated on each change. This lets you know the amount of money left over after expenses. Particularly note the "Savings % of Income" value. This is a percentage calculated by calculating all your income against the remainder of your income after all expenses. Any money above 0% means you're not going backwards. The higher this number, the more you can look to allocate your funds towards investment and paying off debt.

Now that your income and expenses have been entered, go to the Bank Projection page. You'll see a report showing the next three months of your income and expenses mapped to show you how your bank account balance looks over time. Don't worry if it's sloping down indicating that you're going backwards. You've completed the most confronting part. Now that you know where you stand financially you're in a better position to be able to plan towards improving your financial future.

Have a close look at your expenses and see if there are any immediate changes that can be made. Do you really need that magazine subscription? What about eating simpler food and reducing your living expenses budget? If you're not making a surplus, then you're going backwards, which is not ideal.