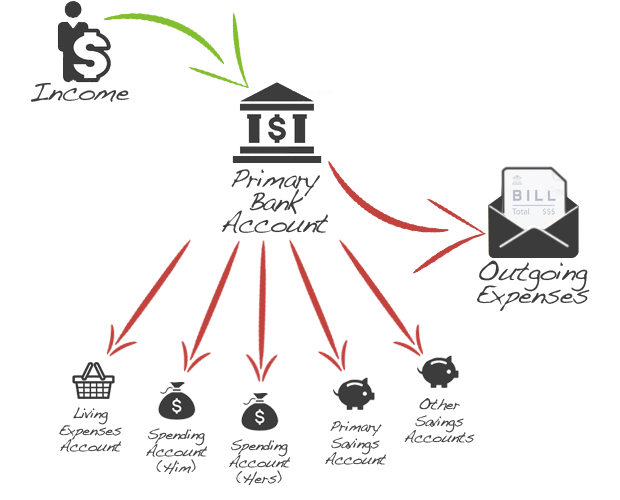

Step 2 - Set Up your Bank Accounts

Many people have a single bank account. It's simple, yes, but it doesn't help when it comes to monitoring and maintaining your financial health. Moolaplan recommends having at least two bank accounts, preferably even more, to allow automated transactions at regular intervals as per below.

Primary Bank Account

Your primary bank account is your central account that all money goes into and all regular, scheduled (weekly, fortnightly, monthly or yearly) expenses go out of and roughly for the same recurring amount of money.

For instance wages are usually the same each week, so they go into this account. A power bill is roughly the same amount of money and at regular recurring intervals, so it too can be paid from this account. If you have a mortgage, have the payments come from this account. You can use a home-loan offset account if you have one to maximise your interest savings. You should not have any card access to this account. You should only be able to access the funds within this account through internet banking.

Secondary Bank Accounts

You will then need to set up additional bank accounts as outlined below

| Account Name | Details |

|---|---|

| Living Expenses (mandatory) | This is to be used as your everyday living account for groceries, fuel and anything that is deemed a necessity for day-to-day living. The purchases are irregular and you can have a card for yourself, your partner and anyone else who helps with day-to-day purchases. There's no need to break this account into tracking categories - the limiting factor is the account running out of money as it gets topped up every week with an amount you specify. |

| Spending money accounts (optional) | These are your own personal accounts - one for each partner. This money is your own personal "splash" money to do with as you please for such purchases as gifts, dining out, alcohol, treats, presents, hobbies etc. |

| Savings account (optional) | A high-interest account that only allows transactions via a website (i.e. Rabo bank or ING direct). It not only has high interest but you need 24 hours before you have access to this money thus reducing the temptation to withdraw it. This is the "do not touch" account and both partners approve any withdrawals from here. |

| Additional Savings Account(s) | If you're planning on purchasing something big like a car, a kitchen renovation, a pool etc., set up a savings account specifically for this purchase rather than taking out a loan. You'll avoid paying a lot of money in interest and be earning interest on your savings in the interim. |

Ensure that all accounts above, apart from the primary or savings accounts, have visa debit functionality and no or very little account keeping fees. Visa debit is usually cheaper and it can be used worldwide. It's like having a credit card without an associated debt.